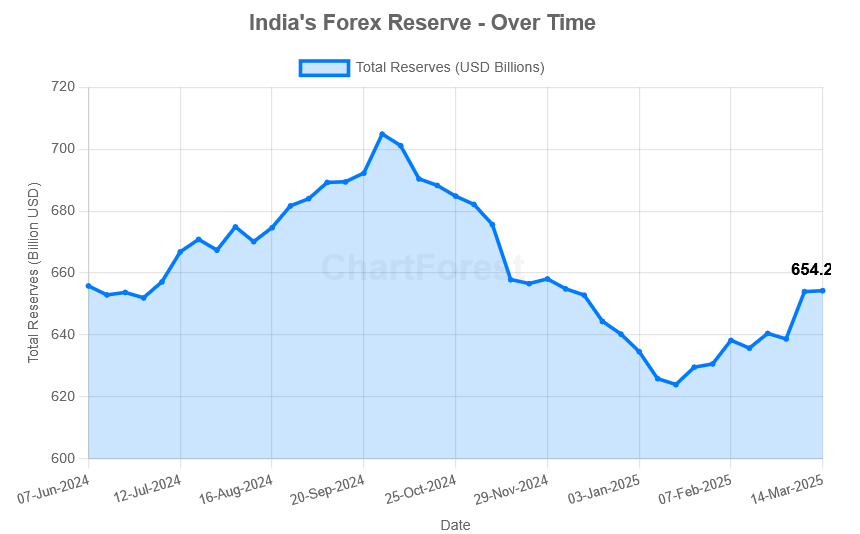

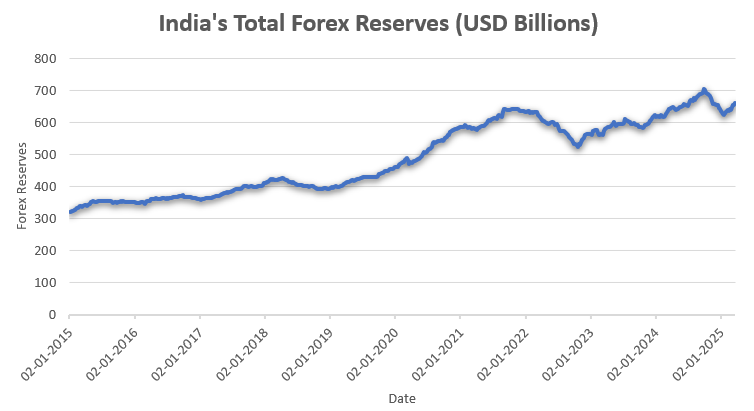

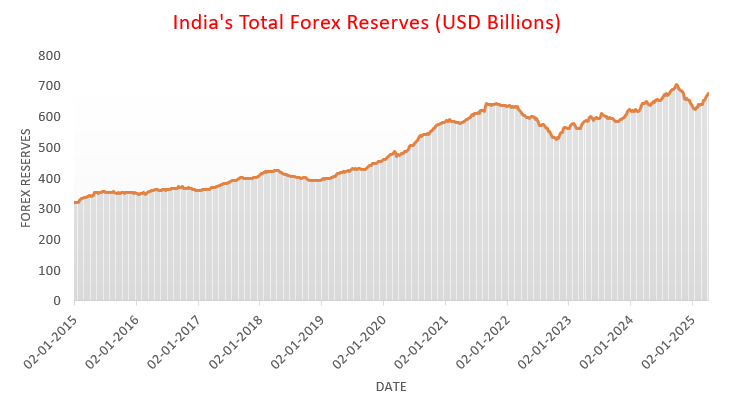

India’s forex reserves experienced a significant rise of $10.88 billion for the week concluding on 4 April 2025, hitting a fresh total of $676.27 billion, as per information disclosed by the Reserve Bank of India (RBI).

Source: Reserve Bank of India

Check out weekly latest updates on India’s Foreign Exchange Reserves “Foreign Exchange (Forex) Reserves of India“. Data is published here as soon as the RBI publishes it.

A Detailed Breakdown of India’s Foreign Exchange Reserves as of April 11th, 2025

According to RBI’s official report, India’s forex reserves increased last week. Below we have mentioned the detailed breakdown of the reserves till 4th April 2025:

| Components | Value (USD) | Description |

| Foreign Currency Assets (FCA) | 574.088B USD | USD, Euro, Pound, Yen – basically the currencies we trade in globally. |

| Gold Reserves | 79.36B USD | Gold is stored both in India & abroad. It’s a golden security blanket. |

| SDRs (Special Drawing Rights) | 18.362B USD | This is a reserve asset or currency for emergencies that was created by the IMF. |

| Reserve Tranche Position (IMF) | 4.459B USD | India’s quota contribution to the IMF. It gives borrowing rights from the IMF when there is a financial crisis. |

What Does This Mean?

Foreign Currency Assets – Up by $9.078 billion, showing strong inflows, probably due to foreign investments or export receipts.

Gold Reserves – Up by $1.57 billion – India’s gold surged and this may reflect a revaluation due to rising global gold prices or strategic buying.

SDRs – A minor dip of $0.186 billion in SDRs. It’s not an alarming situation.

IMF Reserve Tranche – Dropped by $0.046 billion. This is our emergency balance at the IMF. It is slightly adjusted but still safe and accessible.

India’s forex reserves aren’t just about figures. They’re a testament to strength, a reflection of resilience, and a comforting safeguard for challenging times ahead.

Please note that these reserves are influenced by the Reserve Bank of India’s (RBI) interventions in the foreign exchange market. Additionally, changes in the valuation of foreign assets due to exchange rate movements contribute to the weekly fluctuations in reserve levels.