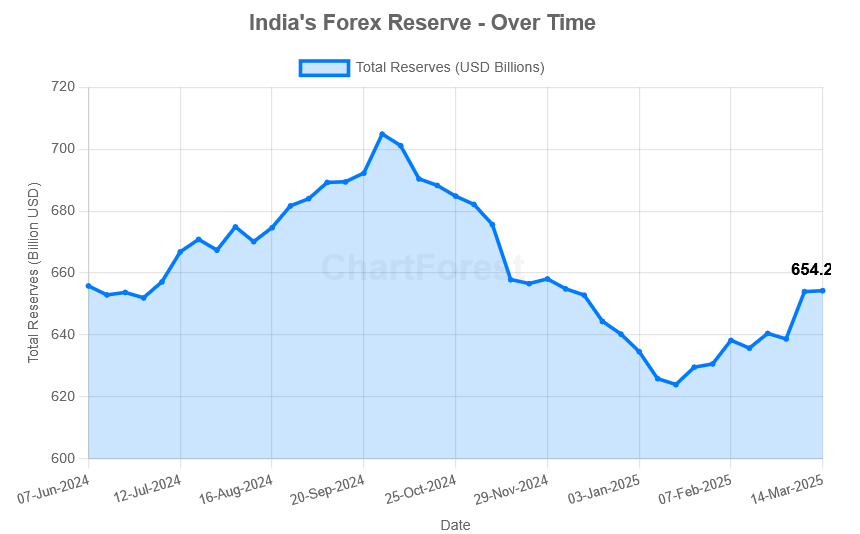

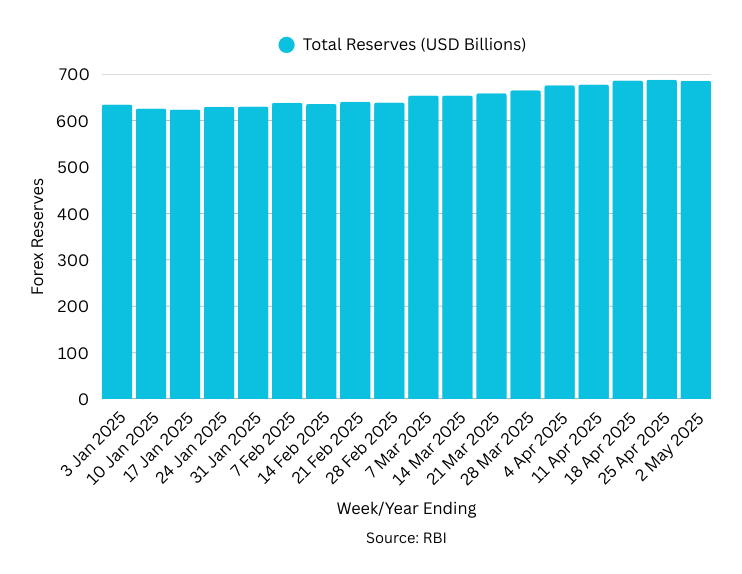

India’s foreign exchange reserves, which serve as a vital measure of the nation’s economic stability and strength, experienced a modest reduction during the week concluding on May 2, 2025. Following eight consecutive weeks of growth, the reserves decreased by $2.07 billion, reaching a total of $686.064 billion. This change occurs in the context of persisting global economic challenges and varying commodity prices.

Weekly Snapshot

Current Week (May 2, 2025): $686.064 billion

Previous Week (April 25, 2025): $688.129 billion

Weekly Change: -$2.065 billion

Check out weekly latest updates on India’s Foreign Exchange Reserves “Foreign Exchange (Forex) Reserves of India“. Data is published here as soon as the RBI publishes it.

Source: Reserve Bank of India

A Detailed Breakdown of India’s Foreign Exchange Reserves as of May 2, 2025

According to RBI’s official report, India’s forex reserves reduced last week. Below we have mentioned the detailed breakdown of the reserves till May 2, 2025:

| Components | Value (USD) | Description |

| Foreign Currency Assets (FCA) | 581.177 Billion | USD, Euro, Pound, Yen – basically the currencies we trade in globally. |

| Gold Reserves | 81.820 Billion | Gold is stored both in India & abroad. It’s a golden security blanket. |

| SDRs (Special Drawing Rights) | 18.558 Billion | This is a reserve asset or currency for emergencies that was created by the IMF. |

| Reserve Tranche Position (IMF) | 4.509 Billion | India’s quota contribution to the IMF. It gives borrowing rights from the IMF when there is a financial crisis. |

What Drove the Change?

The decrease in India’s forex reserves this week was primarily attributed to a sharp drop in the value of gold reserves. Here’s a breakdown of the key factors:

Gold Reserves: The decrease in gold reserves was chiefly caused by a significant $2.55 billion reduction, which occurred due to a decline in international gold prices. Importantly, this decline was not influenced by any active buying or selling activities by the Reserve Bank of India (RBI).

Foreign Currency Assets: Foreign currency assets, which comprise the largest portion of reserves, experienced a notable increase of $514 million. This growth is attributed to favorable valuation adjustments and ongoing inflows of foreign investments, demonstrating their significant role in the overall financial reserves.

SDRs and IMF Reserve Position: The Special Drawing Rights (SDRs), which serve as an international reserve asset created by the International Monetary Fund (IMF), experienced a decrease of $30 million. Similarly, the Reserve Tranche Position, another component of a country’s financial standing with the IMF, saw a $3 million reduction. These changes were due to typical valuation adjustments and transactions associated with the IMF.

What Does This Mean for India?

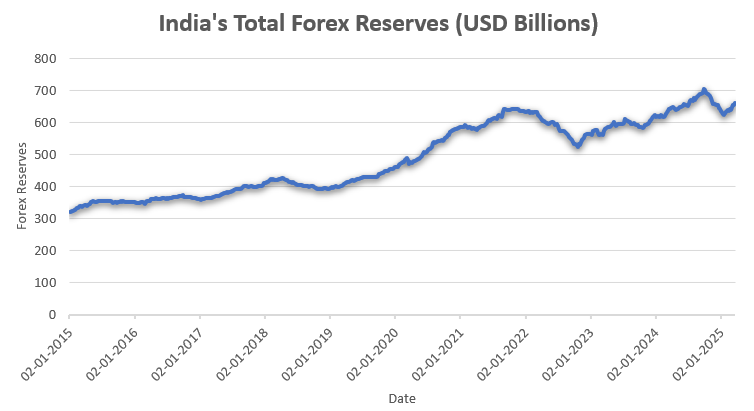

Economic Stability and Consumer Impact: This week’s slight decline in India’s foreign exchange reserves doesn’t overshadow their near record-high status, which serves as a significant buffer against external challenges like fluctuating oil prices, global economic uncertainties, or unexpected capital withdrawals. These strong reserves enable the Reserve Bank of India to support the rupee, facilitate seamless import transactions, and protect Indian consumers from abrupt price hikes caused by currency volatility.

Market Sentiment and Investor Confidence: Maintaining a robust level of reserves is an encouraging indicator for international investors, as it lowers the risk premium associated with Indian assets. This stability promotes steady interest rates and equips the Reserve Bank of India with more options to handle currency fluctuations without needing drastic measures. Despite the recent decrease, the overall strength of the reserves continues to enhance investor trust in India’s macroeconomic framework.

Looking Ahead: Although the eight-week upward trend has ended, it’s important to note that India’s external sector fundamentals are still robust. The slight downturn, mainly due to valuation adjustments in gold, does not indicate any inherent structural issues. Amidst ongoing global market volatility, India’s substantial foreign exchange reserves are crucial in protecting the economy and ensuring continued financial stability.

India’s foreign exchange reserves experienced a minor decrease this week; however, the nation’s external financial situation remains strong. Effective management of reserves, coupled with continuous foreign investment inflows, positions India to effectively handle global uncertainties and maintain its economic growth trajectory.