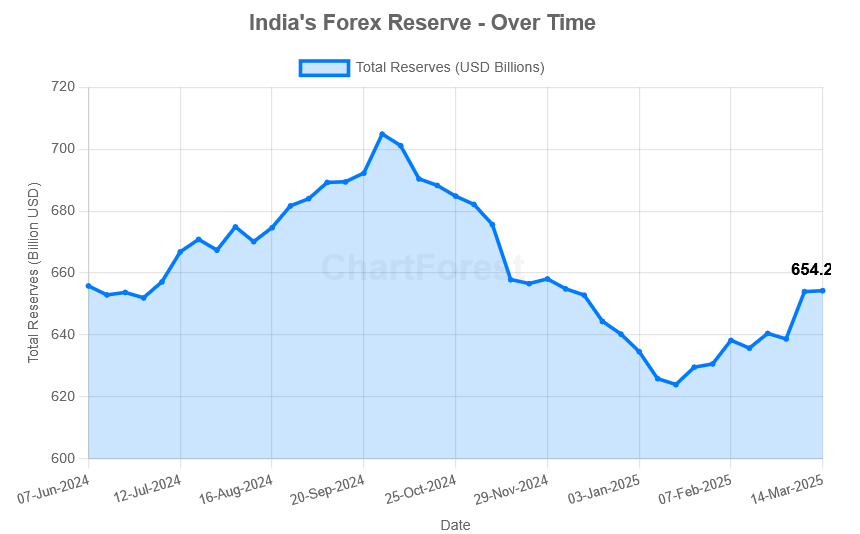

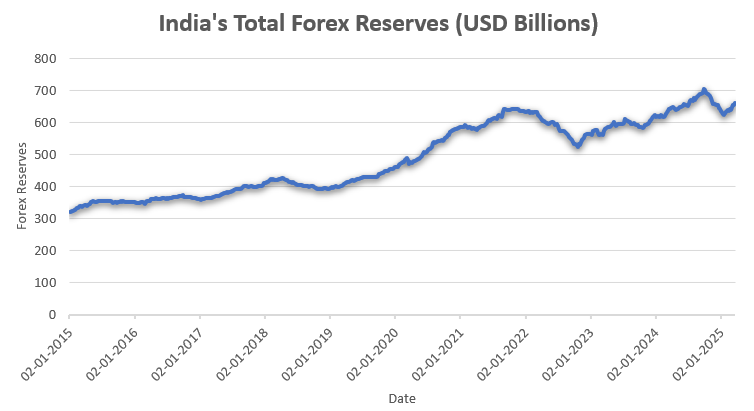

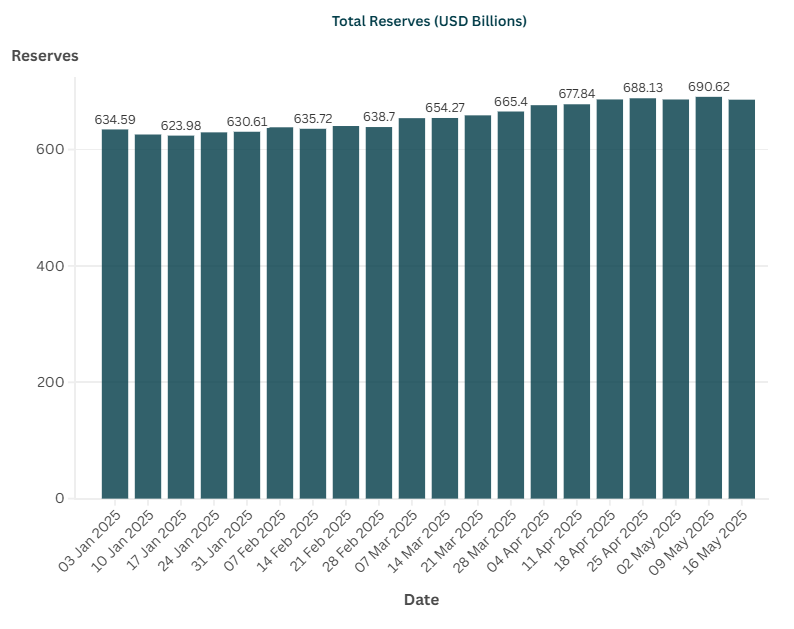

India’s foreign exchange reserves declined during the week ending May 16, 2025, after a gain in the previous week. The reserves fell by $4.888 billion, bringing the total down to $685.729 billion. This movement is attributed primarily to a sharp correction in gold reserves, possibly due to valuation adjustments amid global commodity price volatility.

Weekly Snapshot

Current Week (May 16, 2025): $685.729 billion

Previous Week (May 9, 2025): $690.617 billion

Weekly Change: – $4.888 billion

Stay updated with the latest weekly data on India’s Foreign Exchange Reserves. Figures are published here as soon as the RBI releases them.

Detailed Breakdown of India’s Foreign Exchange Reserves as of May 16, 2025

| Components | Value (USD) | Description |

|---|---|---|

| Foreign Currency Assets (FCA) | $581.652 Billion | USD, Euro, Pound, Yen – basically the currencies we trade in globally. |

| Gold Reserves | $81.217 Billion | Gold is stored both in India & abroad. It’s a golden security blanket. |

| SDRs (Special Drawing Rights) | $18.490 Billion | This is a reserve asset or currency for emergencies that was created by the IMF. |

| Reserve Tranche Position (IMF) | $4.371 Billion | India’s quota contribution to the IMF. It gives borrowing rights from the IMF when there is a financial crisis. |

| Total Reserves | $685.729 Billion | Combined sum of all above. |

What Drove the Weekly Decline?

Gold Reserves Slump

- Gold reserves fell by $5.120 billion, from $86.337B to $81.217B.

- This drop is primarily due to valuation losses caused by international gold price corrections.

- The decline suggests no major fresh purchases and instead reflects market-driven revaluation.

Foreign Currency Assets (FCA)

- FCA increased slightly by $279 million, indicating modest gains from foreign inflows or currency valuation.

SDRs and IMF Position

- SDRs declined by $42 million.

- The IMF Reserve Tranche Position slipped by $3 million, both due to typical valuation changes and account adjustments.

What Does This Mean for India?

Macro Stability: Despite the weekly fall, India’s forex reserves remain robust. They offer a strong shield against external vulnerabilities like rising oil prices, uncertain global markets, and sudden capital outflows. The RBI continues to enjoy flexibility in managing the rupee without aggressive intervention.

Market Sentiment: While gold-led declines may trigger short-term concerns, the underlying reserve strength continues to assure global investors. Stability in forex reserves bolsters confidence in India’s macro fundamentals and reduces risk perception, supporting long-term capital flows and economic planning.

This week’s drop, while notable, reflects routine adjustments in valuation rather than structural issues. India’s overall external position remains healthy and resilient, backed by steady foreign inflows, disciplined fiscal policy, and sound monetary management.

Source: Reserve Bank of India (RBI)