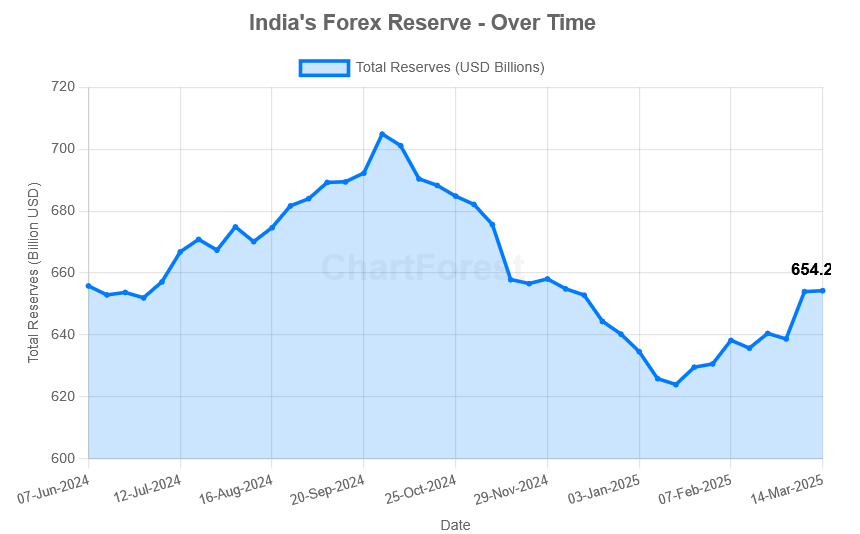

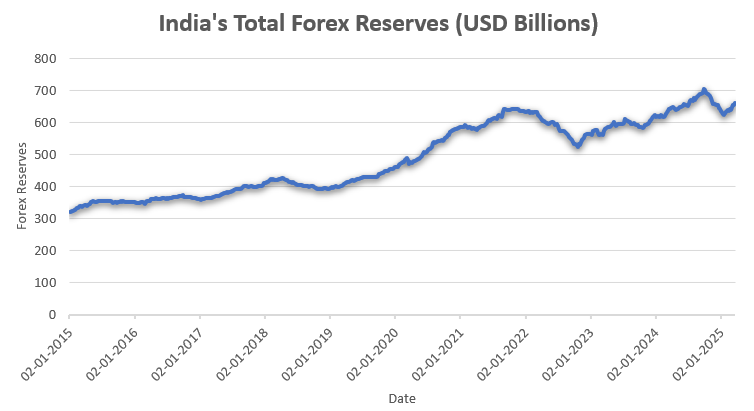

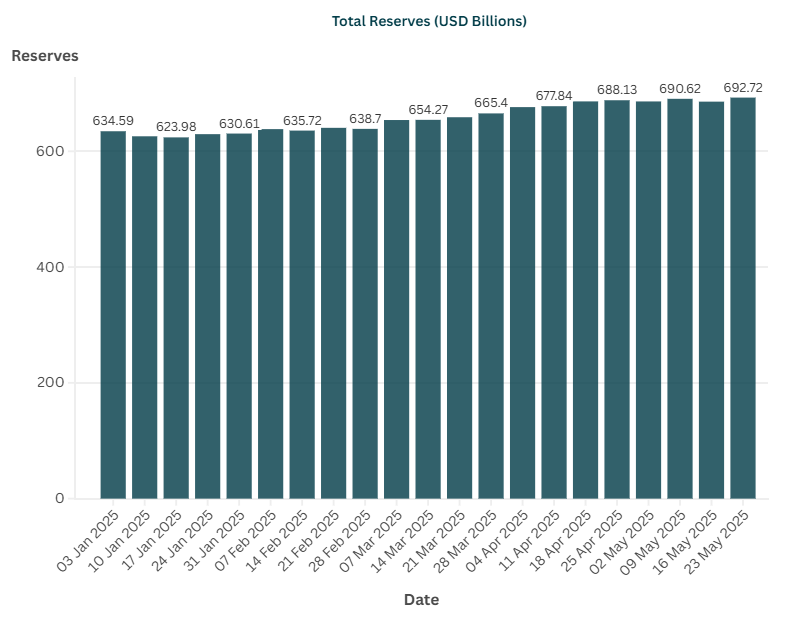

India’s forex reserves rebounded sharply during the week ending May 23, 2025, reversing the previous week’s decline. The reserves surged by $6.992 billion to reach $692.721 billion, reflecting broad-based gains across key components. This uptrend is attributed to positive valuation effects and continued foreign inflows, with both gold and foreign currency assets registering notable increases.

Weekly Snapshot

Current Week (May 23, 2025): $692.721 billion

Previous Week (May 16, 2025): $685.729 billion

Weekly Change: +$6.992 billion

Stay updated with the latest weekly data on India’s Foreign Exchange Reserves. Figures are published here as soon as the RBI releases them.

Detailed Breakdown of India’s Foreign Exchange Reserves as of May 23, 2025

| Components | Value (USD) | Description |

|---|---|---|

| Foreign Currency Assets (FCA) | $586.167 Billion | USD, Euro, Pound, Yen – basically the currencies we trade in globally. |

| Gold Reserves | $83.582 Billion | Gold is stored both in India & abroad. It’s a golden security blanket. |

| SDRs (Special Drawing Rights) | $18.571 Billion | This is a reserve asset or currency for emergencies that was created by the IMF. |

| Reserve Tranche Position (IMF) | $4.401 Billion | India’s quota contribution to the IMF. It gives borrowing rights from the IMF when there is a financial crisis. |

| Total Reserves | $692.721 Billion | Combined sum of all above. |

What Drove the Weekly Increase?

Gold Reserves Surge: Gold reserves rose by $2.365 billion, from $81.217 billion to $83.582 billion. This increase is primarily due to valuation gains as international gold prices rebounded, with potential minor additions to physical holdings.

Foreign Currency Assets (FCA): FCA increased by $4.515 billion, indicating strong foreign inflows and favorable currency revaluation, reflecting the impact of non-dollar currencies appreciating against the US dollar.

SDRs and IMF Position: SDRs rose by $81 million, while the IMF Reserve Tranche Position increased by $30 million, both reflecting routine adjustments and valuation changes.

What Does This Mean for India?

Macro Stability: India’s forex reserves are once again near record highs, providing a strong buffer against external shocks such as volatile oil prices, global market uncertainty, or sudden capital outflows. The RBI retains significant flexibility to manage the rupee and market liquidity without aggressive intervention.

Market Sentiment: The broad-based increase reassures global investors about India’s macroeconomic fundamentals. Robust reserves reduce risk perception, support stable capital flows, and provide confidence for long-term economic planning.

This week’s sharp rise reflects positive valuation adjustments and healthy foreign inflows, underscoring the resilience and sound management of India’s external sector.

Source: Reserve Bank of India (RBI)