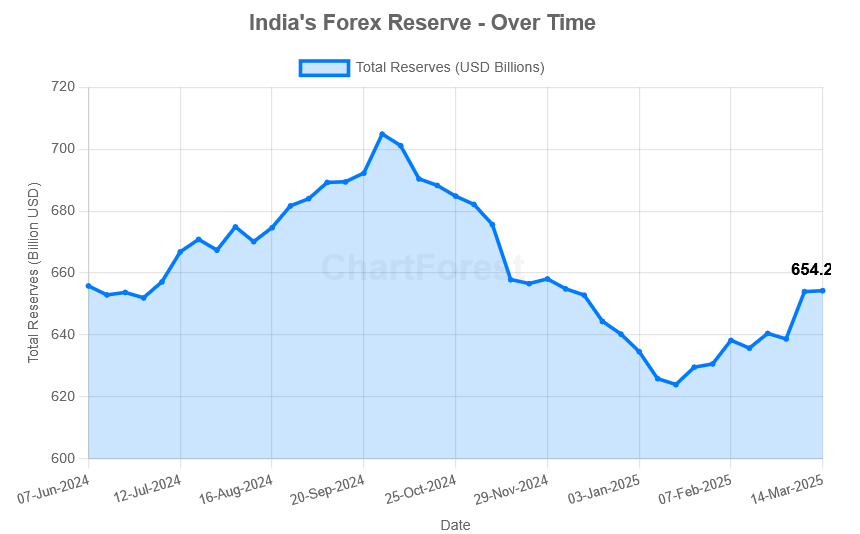

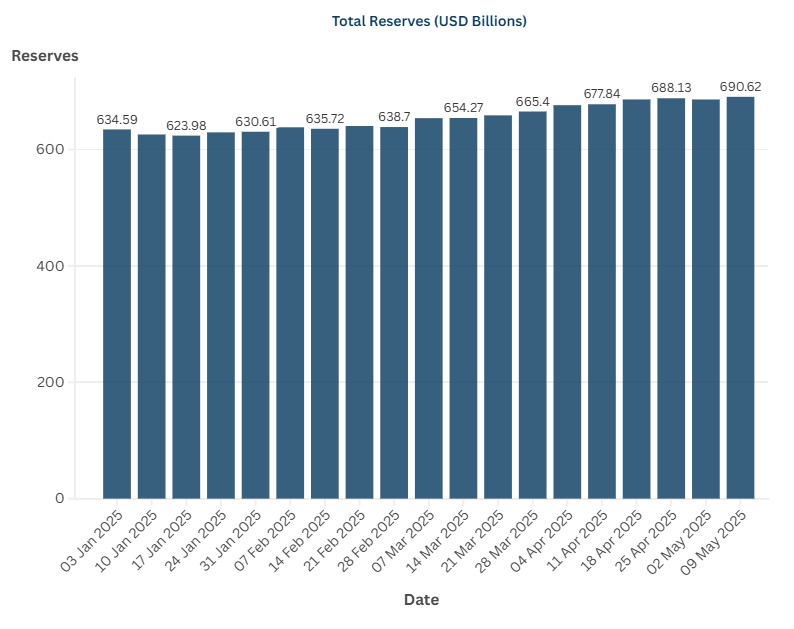

India’s forex reserves experienced an increase during the week ending May 9, 2025, following a short decline previously. The reserves rose by $4.553 billion, bringing the total to $690.617 billion. This adjustment occurs within the context of global economic fluctuations and changes in commodity prices.

Weekly Snapshot

Current Week (May 9, 2025): $690.617 billion

Previous Week (May 2, 2025): $686.064 billion

Weekly Change: + $4.553 billion

Stay updated with the latest weekly data on India’s Foreign Exchange Reserves. Figures are published here as soon as the RBI releases them.

Detailed Breakdown of India’s Foreign Exchange Reserves as of May 9, 2025

| Components | Value (USD) | Description |

|---|---|---|

| Foreign Currency Assets (FCA) | $581.373 Billion | USD, Euro, Pound, Yen – basically the currencies we trade in globally. |

| Gold Reserves | $86.337 Billion | Gold is stored both in India & abroad. It’s a golden security blanket. |

| SDRs (Special Drawing Rights) | $18.532 Billion | This is a reserve asset or currency for emergencies that was created by the IMF. |

| Reserve Tranche Position (IMF) | $4.374 Billion | India’s quota contribution to the IMF. It gives borrowing rights from the IMF when there is a financial crisis. |

| Total Reserves | $690.617 billion | Combined sum of all above. |

What Drove the Weekly Increase?

Gold Reserves Surge

- Gold reserves rose by $4.517 billion, from $81.820B to $86.337B.

- This jump was mainly due to valuation gains from rising international gold prices.

- Metric tonnes held also increased from 81,820 to 86,337, suggesting potential fresh purchases or revaluation adjustments.

Foreign Currency Assets (FCA)

- FCA increased marginally by $196 million, reflecting continued inflows and revaluation gains.

- Strong inflows from FDI, remittances, and trade receipts continue to support FCA levels.

Decline in SDRs and IMF Position

- SDRs fell by $26 million and the IMF Reserve Tranche by $135 million, largely due to routine valuation changes and withdrawals.

What Does This Mean for India?

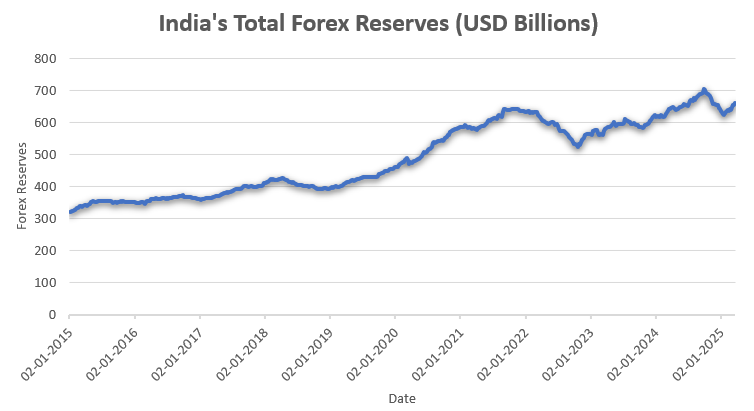

Macro Stability: India’s foreign exchange reserves are close to record highs, offering a significant safeguard against external challenges like fluctuating oil prices, global economic uncertainties, and unexpected capital outflows. This strong reserve status enables the Reserve Bank of India to stabilize the rupee, facilitate smooth import activities, and protect consumers from sudden price changes caused by currency fluctuations.

Market Sentiment and Investor Confidence: A strong reserve level serves as an encouraging indicator for international investors, potentially lowering the risk premium on Indian assets. This stability aids in maintaining consistent interest rates and provides the Reserve Bank of India with greater latitude to address currency fluctuations without drastic interventions. The recent rise in reserves has bolstered investor confidence in India’s macroeconomic steadiness.

This week, India’s foreign exchange reserves experienced a notable increase, reflecting the country’s stable external position. Efficient management of reserves and consistent inflows of foreign investments prepare India to handle global uncertainties while maintaining its economic growth path.

Source: Reserve Bank of India