India’s Goods and Services Tax (GST) collections demonstrated notable strength, reaching a gross revenue of ₹2,01,050 crore in May 2025. This figure represents an impressive 16.4% increase compared to May 2024. Such healthy growth indicates the country’s sustained economic robustness, enhanced adherence to tax regulations, and the effectiveness of administrative processes.

Important Key Points

- Gross GST Revenue: ₹2,01,050 crore — a 16.4% increase compared to ₹1,72,739 crore in May 2024.

- Net GST Revenue: ₹1,73,841 crore — a 20.4% increase compared to ₹1,44,381 crore in May 2024.

- Domestic GST Revenue: ₹1,49,785 crore — a 13.7% increase compared to ₹1,31,783 crore in May 2024.

- Import GST Revenue: ₹51,266 crore — a 25.2% increase compared to ₹40,956 crore in May 2024.

- Refunds: ₹27,210 crore — a 4.0% decline compared to ₹28,357 crore in May 2024.

- State-wise Growth: Varied widely — highest growth in Lakshadweep (445%), Manipur (102%), and Ladakh (89%); while some states saw negative growth, such as Mizoram (-26%) and Andhra Pradesh (-2%).

Check out the latest monthly updates on India’s GST Revenue “Goods and Services Tax (GST)“. Data is published here as soon as the govt publishes it.

The Central Board of Indirect Taxes and Customs (CBIC) has released the preliminary figures for Goods and Services Tax (GST) collections for May 2025, showcasing significant year-on-year growth across revenue components and regions. The report highlights key metrics including gross and net collections, tax-wise performance (CGST, SGST, IGST, Cess), and state-wise revenue trends. It provides a comprehensive view of India’s indirect tax landscape and underscores continued momentum in economic activity and tax compliance.

Aggregate GST Collections Overview

GST Revenue Summary Table (May 2025 vs May 2024)

| Category | May 2024 (₹ crore) | May 2025 (₹ crore) | Growth (%) |

|---|---|---|---|

| Gross GST Revenue | 1,72,739 | 2,01,050 | 16.4% |

| Total Refunds | 28,357 | 27,210 | -4.0% |

| Net GST Revenue | 1,44,381 | 1,73,841 | 20.4% |

Please Note:

- Gross GST comprises domestic supplies (CGST, SGST, IGST, CESS on domestic transactions) and import duties (IGST and CESS on imports).

- Refunds include domestic refunds and export-related ICEGATE refunds.

- Net GST is computed by subtracting total refunds from gross collections.

- Figures are provisional and subject to revision upon finalization.

Component-wise GST Revenue Collection Breakdown

| Component | Gross (₹ Cr) | Refund (₹ Cr) | Net (₹ Cr) |

|---|---|---|---|

| Central GST (CGST) | 35,434 | 4,243 | 31,191 |

| State GST (SGST) | 43,902 | 5,391 | 38,511 |

| Integrated GST (IGST) | 1,08,836 | 17,159 | 91,677 |

| Compensation Cess | 12,879 | 417 | 12,462 |

| Total | 2,01,050 | 27,210 | 1,73,841 |

Note: Figures presented are preliminary and might experience slight modifications upon final confirmation.

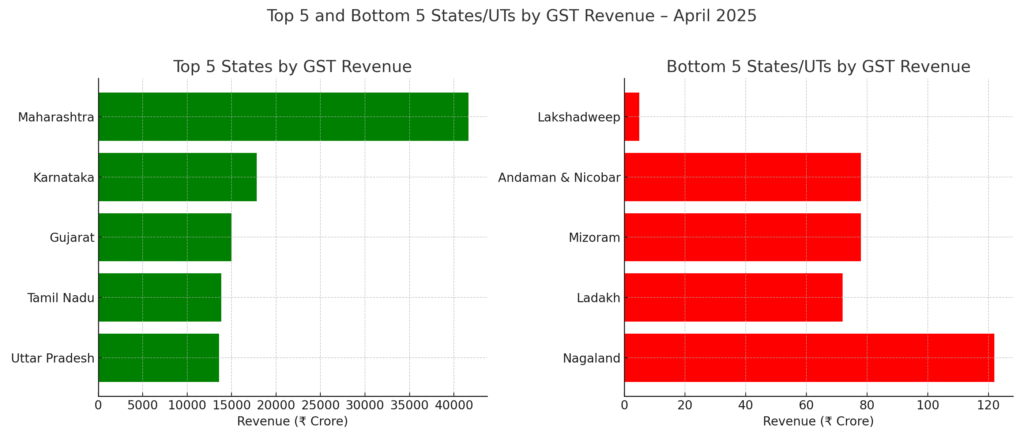

State-Wise Gross GST Revenue Collection (April 2025 vs April 2024)

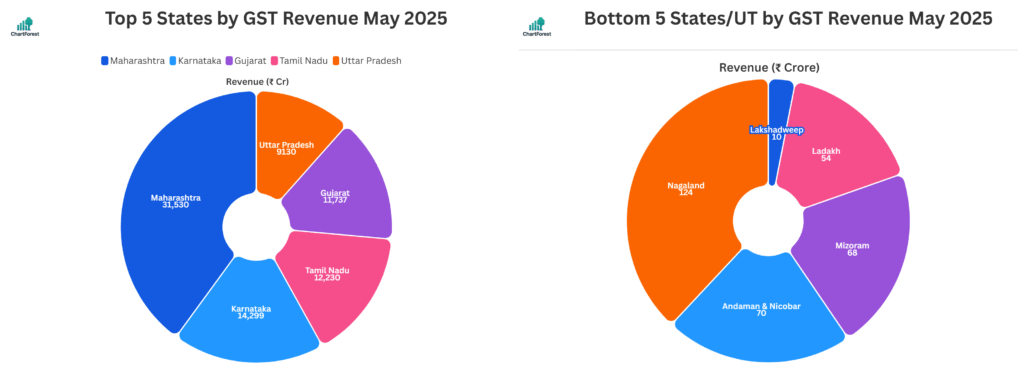

Below mentioned table shows the full state-wise data of Gross GST Revenue for May 2025 compared to May 2024. This table lists all States and Union Territories, showing their collections and growth rates:

| Category | May 2024 (₹ crore) | May 2025 (₹ crore) | Growth (%) |

|---|---|---|---|

| Jammu and Kashmir | 525 | 578 | 10% |

| Himachal Pradesh | 838 | 849 | 1% |

| Punjab | 2,190 | 2,414 | 10% |

| Chandigarh | 237 | 363 | 53% |

| Uttarakhand | 1,837 | 1,605 | -13% |

| Haryana | 9,289 | 10,170 | 9% |

| Delhi | 7,512 | 10,366 | 38% |

| Rajasthan | 4,414 | 4,837 | 10% |

| Uttar Pradesh | 9,091 | 9,130 | 0% |

| Bihar | 1,521 | 1,871 | 23% |

| Sikkim | 312 | 424 | 36% |

| Arunachal Pradesh | 98 | 151 | 53% |

| Nagaland | 45 | 65 | 46% |

| Manipur | 59 | 118 | 102% |

| Mizoram | 39 | 29 | -26% |

| Tripura | 73 | 92 | 27% |

| Meghalaya | 172 | 212 | 23% |

| Assam | 1,228 | 1,592 | 30% |

| West Bengal | 5,377 | 6,321 | 18% |

| Jharkhand | 2,700 | 2,907 | 8% |

| Odisha | 5,027 | 5,108 | 2% |

| Chhattisgarh | 2,853 | 2,891 | 1% |

| Madhya Pradesh | 3,402 | 3,733 | 10% |

| Gujarat | 11,325 | 11,737 | 4% |

| Dadra and Nagar Haveli & Daman and Diu | 375 | 351 | -6% |

| Maharashtra | 26,854 | 31,530 | 17% |

| Goa | 519 | 587 | 13% |

| Lakshadweep | 1 | 7 | 445% |

| Kerala | 2,594 | 3,210 | 24% |

| Tamil Nadu | 9,768 | 12,230 | 25% |

| Puducherry | 239 | 275 | 15% |

| Andaman and Nicobar Islands | 37 | 53 | 45% |

| Telangana | 4,986 | 5,310 | 6% |

| Karnataka | 11,889 | 14,299 | 20% |

| Andhra Pradesh | 3,890 | 3,803 | -2% |

| Ladakh | 15 | 29 | 89% |

| Other Territory | 207 | 212 | 2% |

| Center Jurisdiction | 245 | 324 | 32% |

| Grand Total | 1,31,783 | 1,49,785 | 13.66% |

Note: This table does not include GST on the import of goods.

Key Drivers of Performance

In light of various global challenges, such as supply chain disruptions and geopolitical tensions, India’s GST collections have shown impressive resilience. This showcases strong domestic economic activity, improved tax compliance, and an effective administrative system. Below we have mentioned a few points that may be points for this GST revenue performance.

Economic Momentum: The 16.4% growth in overall GST collections, alongside a 25.2% rise in GST revenue from imports, points to vigorous economic activity. This uptick suggests boosted domestic consumption, thriving industrial production, and an escalated demand for imported goods and services. Additionally, the consistent increase in GST revenues across major industrial regions reinforces the idea of widespread economic expansion.

Compliance and Administration: Although there was a slight decline of 4.0% in total refunds, domestic refunds increased significantly by 53.7%, reflecting improved processing efficiency. This improvement indicates better administrative performance by tax authorities, which includes faster verification processes, more effective tracking systems, and more streamlined disbursements. Such advancements help provide essential working capital relief for businesses, thereby supporting their liquidity and operational cycles.

State-Level Performance: The majority of states witnessed significant revenue growth every year, with certain areas like Delhi experiencing a 38% increase, Manipur seeing a significant 102% rise, and Lakshadweep exhibiting an exceptional 445% growth. Conversely, some regions, including Mizoram with a decline of 26%, and Uttarakhand with a 13% decrease, faced negative growth rates. This variation highlights the need for tailored economic strategies that cater specifically to each region’s unique circumstances to achieve an equitable recovery nationwide.

Fiscal and Policy Implications: Continued growth in GST collections strengthens the fiscal capabilities of both the Central and State governments, allowing them to allocate more funds toward infrastructure projects, employment initiatives, and social welfare programs. This surge in revenue, supported by improved tax compliance and advanced digital tracking systems, contributes to establishing a transparent and resilient tax system.

The GST figures from May 2025 highlight the development and stability of the tax system in India, bolstered by strengthening economic trust, significant structural changes, and improved administrative processes. With India’s ongoing efforts to digitize and extend its tax reach, the consistent monthly increases in GST reveal promising fiscal prospects for the coming months.

Source: GST Portal, Government of India