India Inflation rate

India's Inflation Rate: Key Updates

Latest Release

April, 2025

Current

3.34%

Previous

3.61%

- Overall Inflation: The year-on-year inflation rate based on the All India Consumer Price Index (CPI) for March 2025 is 3.34% (provisional) as per the recent CPI published data in April month.

- Previous Month: In February 2025, the inflation rate was 3.61%.

- Indication: The decrease in the inflation rate indicates a general easing of price pressures in the economy.

- Reasons for Change: The decline is attributed to decreases in the inflation of essential items like vegetables, eggs, and pulses.

- Impact on Market: A lower inflation rate may lead to expectations of potential interest rate cuts by the central bank, which can boost market sentiment.

Above mentioned rate shows the Combined (Rural+Urban) inflation rate.

Please Note: Data published in April represents the inflation rate for March. This is because it is calculated and reported for the previous month after analyzing price changes.

India Inflation Rate Chart

India Inflation Chart - Historical & Current Trends. Analyze inflation Rate Changes Over Time

Inflation Rate overview

The Consumer Price Index, or CPI, is an important way to keep tabs on inflation by looking at how the prices of everyday goods and services change over time. In India, it’s a key resource that helps policymakers, economists, and businesses understand inflation trends and make smart decisions about monetary and fiscal policies.

It is a macroeconomic indicator used by the government and the RBI for maintaining price stability and managing money supply.

It serves as a measure of the purchasing power of the Indian rupee. As the inflation rate increases, the purchasing power decreases, meaning the same amount of money can buy fewer goods and services.

The Reserve Bank of India (RBI) relies on the Consumer Price Index (CPI) to guide its monetary policy decisions. If inflation starts climbing, as shown by a rising CPI, the RBI might raise interest rates to slow down the flow of money in the economy and help keep inflation in check.

What does CPI Inflation Tells Us

- The cost of living is a measure of how much it takes to cover everyday expenses and maintain a comfortable lifestyle.

- The purchasing power of consumers shows how many goods and services people can afford.

- It gives you a clear idea of the prices for everyday items that people often buy.

- The value of the Indian rupee is tied to changes in inflation, as it shows how the real worth of the currency shifts over time.

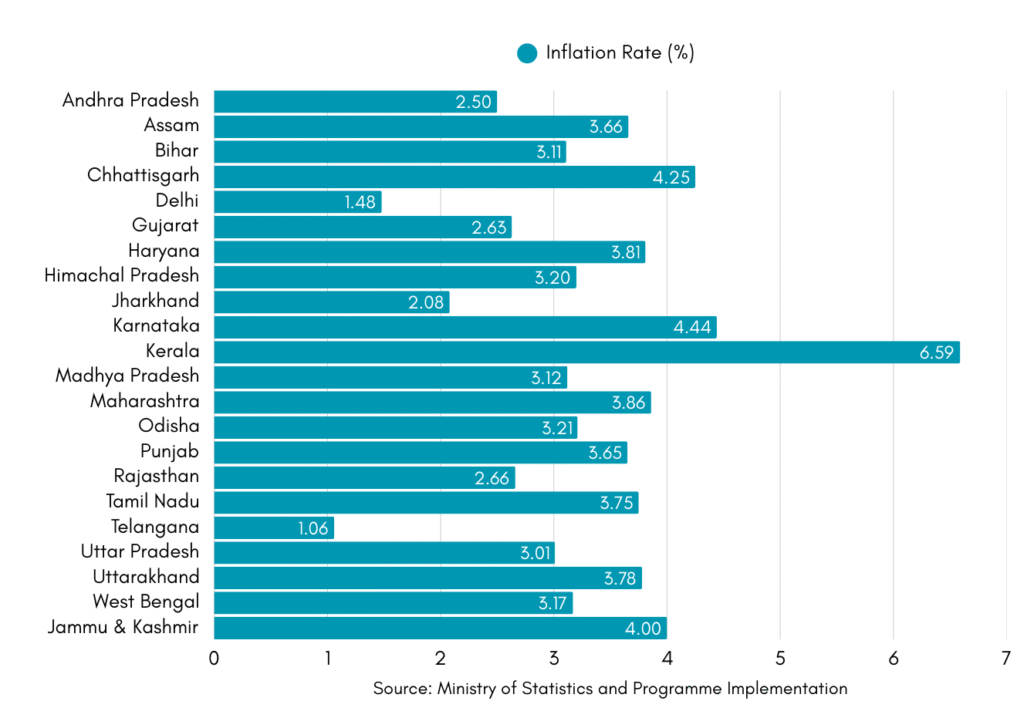

Inflation Rate State/UT wise

Here is the chart and table containing the latest month’s Inflation Rate and Index Prices, state-wise:

Inflation Rate State/UT Wise

| Name of the State/UT | March 2025 Index (Prov.) | March 2025 Inflation Rate (%) |

| Andhra Pradesh | 196.5 | 2.5 |

| Assam | 195.4 | 3.66 |

| Bihar | 188.8 | 3.11 |

| Chhattisgarh | 183.8 | 4.25 |

| Delhi | 171.9 | 1.48 |

| Gujarat | 183.2 | 2.63 |

| Haryana | 190.7 | 3.81 |

| Himachal Pradesh | 180.4 | 3.2 |

| Jharkhand | 186.9 | 2.08 |

| Karnataka | 199.8 | 4.44 |

| Kerala | 205.3 | 6.59 |

| Madhya Pradesh | 191.6 | 3.12 |

| Maharashtra | 188.4 | 3.86 |

| Odisha | 192.7 | 3.21 |

| Punjab | 184.5 | 3.65 |

| Rajasthan | 189.3 | 2.66 |

| Tamil Nadu | 199.1 | 3.75 |

| Telangana | 200.2 | 1.06 |

| Uttar Pradesh | 191.9 | 3.01 |

| Uttarakhand | 189.4 | 3.78 |

| West Bengal | 195 | 3.17 |

| Jammu & Kashmir* | 202.7 | 4 |

* Figures of this row pertain to the prices and weights of the combined Union Territories of Jammu & Kashmir and Ladakh (erstwhile State of Jammu & Kashmir).

Related Inflation and Price Indicators

- CPI Inflation

- WPI Inflation

- Education Inflation

- CPI Housing Utilities

- Food Inflation

- Health Inflation

- WPI Food Index

- WPI Fuel & Power

- WPI Manufacturing

- Inflation Expectations

Important

If you notice any discrepancies in the data or find any inaccuracies, please let us know. We will review and correct them as soon as possible.

Other Indicators

GDP & Economic Growth Indicator

- GDP

- Full Year GDP Growth

- GDP per Capita

- GDP from Agriculture

- GDP from Construction

FAQs

What is the Inflation Rate and what does it indicate?

Inflation rate is basically the percentage change in the average cost of goods and services over a set time, like a month or a year. It’s a way to measure how quickly prices are going up and how much less your money can buy over time.

Why is the Inflation Rate important?

The inflation rate is an essential part of shaping economic planning and policies—it touches everything from interest rates to wages, savings, and how much we actually earn from investments. Central banks, like the Reserve Bank of India (RBI), keep a close eye on inflation to fine-tune monetary policies, such as tweaking the repo rate, all to keep prices steady and under control. A moderate inflation rate is usually a good sign, showing the economy is growing at a healthy pace, but when inflation gets too high, it can chip away at our purchasing power and stir up economic uncertainty.

What are the main factors that influence the Inflation Rate?

There are a few factors that can influence inflation, like when demand for goods and services goes up, or when production costs, such as wages and raw materials, increase. Things like supply chain hiccups, shifts in monetary policy or fuel prices, and even currency depreciation can also play a role.

How does inflation impact everyday life and the economy?

Inflation has a big impact on our daily lives, changing the cost of living and stretching our budgets. When prices go up, the same amount of money doesn’t go as far, making it harder to afford the things we need. It also shapes borrowing costs, investment choices, government spending, and how businesses plan for the future. Keeping inflation in check is so important—not just for the economy, but for helping families protect their incomes and stay financially secure.