The 54th Monetary Policy Committee (MPC) meeting took place from April 7 to 9, 2025, with Shri Sanjay Malhotra, the Governor of the Reserve Bank of India, leading the discussions.

RBI Monetary Policy Review and Decisions

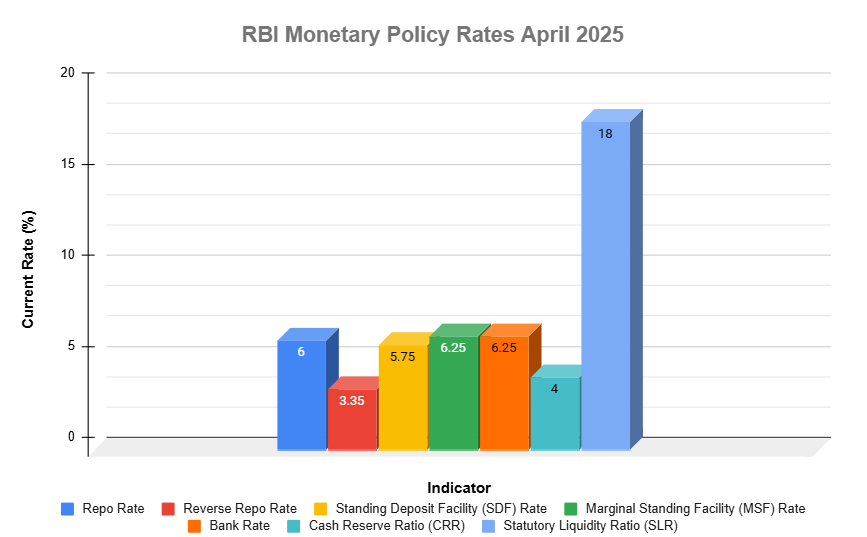

After carefully reviewing the changing economic environment, the MPC has decided together to lower the policy repo rate by 25 basis points to 6.00%, effective right away. This means the Standing Deposit Facility (SDF) rate under the Liquidity Adjustment Facility (LAF) is now 5.75%, and both the Marginal Standing Facility (MSF) rate and the Bank Rate are set at 6.25%.

This step is aimed at keeping inflation near the medium-term target of 4%, within a tolerance range of +/- 2%, while also giving a gentle push to economic growth.

Check out the historical monetary policy rate here: “RBI’s Repo Rate Policy“. Data is published here as soon as the RBI publishes it.

Outlook on Growth and Inflation

Now let’s see the global conditions and our domestic inflation and growth outlook.

Global and Domestic Growth

The global economy is going through some unpredictable times, and the latest trade tariff measures have only added to the uncertainty. It’s been causing quite a stir in the markets, with the US dollar index taking a noticeable dip, equity markets seeing sell-offs, and bond yields and crude oil prices easing up too.

The National Statistics Office (NSO) projects real GDP growth at 6.5% for 2024–25, following a strong 9.2% rise in 2023–24. On the horizon, rural demand looks steady, urban spending is set to bounce back, and investment activity helped by higher government funding, better use of capacity, and improved financial health of companies and banks promises to keep driving the economy forward.

Although merchandise exports are feeling the pressure from global uncertainties, services exports are holding strong and showing resilience. On the brighter side, agriculture looks promising, industrial activity is making a steady comeback, and the services sector is doing quite well. Still, challenges from global trade disruptions could pose some risks going forward.

Considering all these factors, real GDP growth for 2025–26 is expected to be around 6.5%, with estimates broken down by quarter to give a clearer picture.

Q1: 6.5%

Q2: 6.7%

Q3: 6.6%

Q4: 6.3%

The chances for growth seem to be pretty balanced overall.

Inflation Trends and Forecast

Inflation took a noticeable dip early in 2025, with CPI dropping by 1.6 percentage points between January and February from 5.2% in December 2024 down to 3.6% by February. A big part of this change came from a seasonal drop in vegetable prices, which pushed food inflation to its lowest level in nearly two years at 3.8%, while fuel prices stayed in deflation.

Core inflation stayed steady in December 2024 and January 2025, but it ticked up to 4.1% in February, mostly because gold prices took a noticeable jump.

However, it’s great to see food inflation finally looking up! Vegetable prices have benefited from a seasonal dip, and the uncertainties around the Rabi crop seem to have settled down nicely. Estimates show record wheat production and a boost in key pulses. Plus, with strong kharif crop arrivals, all of this is coming together to bring some much-needed relief on the food inflation front.

On a positive note, the drop in short- and medium-term inflation expectations, along with lower crude oil prices, is giving us a pretty encouraging outlook. That said, we still need to keep an eye on global uncertainties and possible weather-related supply issues, which could pose some challenges moving forward.

With the expectation of a typical monsoon season, CPI inflation for 2025–26 is anticipated to be around 4.0%, with quarterly projections mapped out accordingly.

Q1: 3.6%

Q2: 3.9%

Q3: 3.8%

Q4: 4.4%

The risks of inflation are seen as being pretty evenly balanced.

Policy Rationale

The Monetary Policy Committee noted that inflation is currently below the target, thanks to a sharp drop in food prices. Things are looking much brighter on the inflation front, and there’s growing optimism about staying on track to meet the 4% target in the next year.

Growth is steadily bouncing back despite the tough global backdrop, especially after a slower start in the first half of 2024–25. While the outlook seems balanced with risks on both sides, the unpredictability of global trends still adds a layer of uncertainty.

With inflation staying manageable and the need to keep the recovery on track, the MPC decided together to lower the policy repo rate by 25 basis points to 6.00%. They also shifted their approach to an ‘accommodative’ stance, showing their dedication to boosting economic growth while ensuring inflation stays under control.

The Committee highlighted that the situation is still evolving and stressed the importance of keeping a close eye on it, with thoughtful, data-driven adjustments to policies as needed.