RBI Marginal Standing Facility (MSF) Rate

RBI's MSF Policy: Key Updates

Latest Release

June 6, 2025

Actual

5.75%

Previous

6.25%

Highlights

- After assessing the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) decided to reduce the Marginal Standing Facility (MSF) rate to 5.75 percent, following a 50 basis point cut in the policy repo rate.

- The decision was taken during the 55th meeting of the MPC held from June 4 to 6, 2025, chaired by RBI Governor Shri Sanjay Malhotra.

- The MSF rate, which serves as the upper bound of the Liquidity Adjustment Facility (LAF) corridor, helps the RBI manage the emergency borrowing needs of banks.

Reasons Behind MSF Rate Reduction (June 2025)

As per the June 2025 Monetary Policy Statement:

- Decline in Inflation: CPI inflation eased to 3.2% in April 2025, a 6-year low, led by continued decline in food inflation and stable core inflation.

- Inflation Forecast Revised: Inflation for FY 2025-26 is now projected at 3.7%, down from the earlier 4%.

- Support for Growth: Economic growth, though improving, is still below potential at 6.5%, requiring policy support.

- Strong Agri Outlook: Higher Rabi output and a forecast of an above-normal monsoon are expected to ease food supply constraints.

- External Risks Persist: Global economic uncertainty, trade frictions, and geopolitical risks remain, warranting a proactive stance.

- Policy Space Utilized: With inflation under control, the RBI utilized available space to lower both repo and MSF rates to support liquidity and growth.

Expected Effects of MSF Rate Cut

- Emergency Liquidity Access: Reduces the cost for banks borrowing overnight funds from RBI during tight liquidity conditions.

- Upper Limit Adjustment: Keeps the LAF corridor aligned with overall monetary policy direction, ensuring smoother liquidity operations.

- Market Confidence: Reinforces RBI’s commitment to ensuring adequate and affordable liquidity in the financial system.

- Enhanced Credit Availability: Encourages banks to maintain comfortable liquidity levels, indirectly improving credit flow to the economy.

Historical RBI's MSF Data Chart

MSF Rate Chart (RBI) - Historical & Current Trends

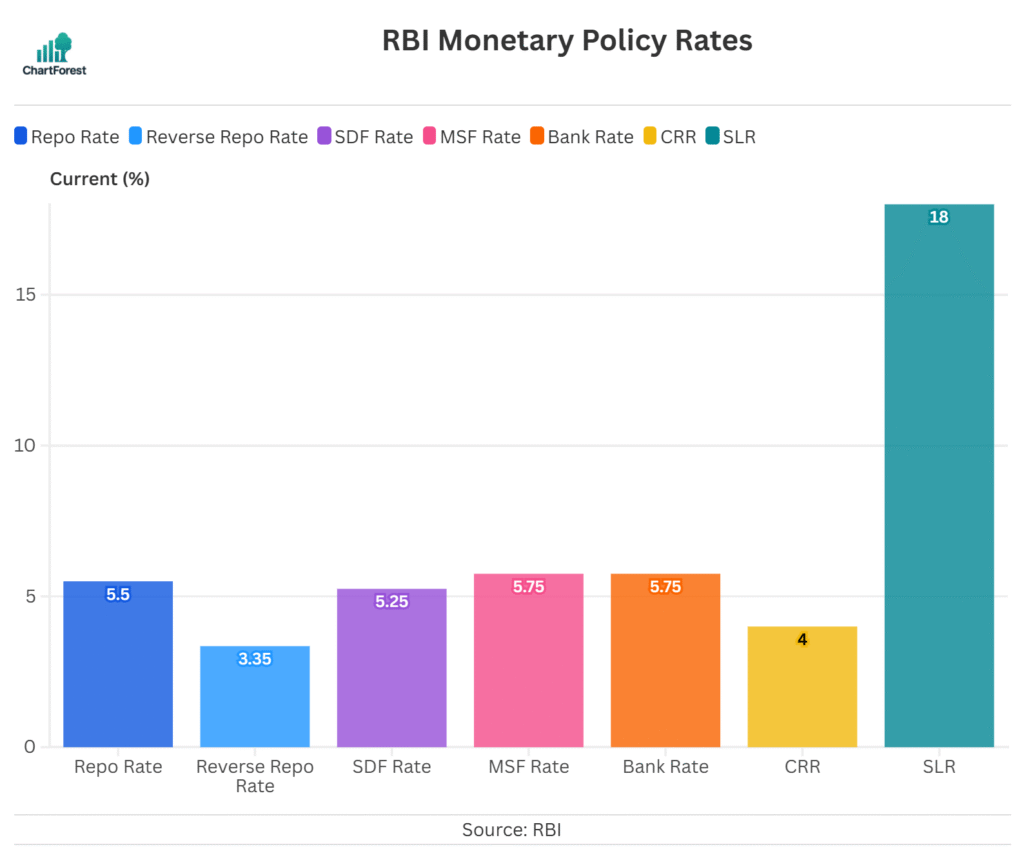

RBI Policy Rates & Ratios

RBI's Marginal Standing Facility (MSF) Rate overview

MSF is a facility that commercial banks use. Banks (govt and private) can borrow funds overnight against their Statutory Liquidity Ratio (SLR) securities when interbank liquidity is scarce. It was introduced in 2011-12 to help financial institutions manage short term liquidity problems.

Banks use it as an emergency funding option. The interest rate on MSF (MSF Rate) is higher than the repo rate to discourage banks from using it frequently.

The MSF aims to maintain stability in the banking system, manage short-term liquidity fluctuations, and avoid financial crisis.

Borrowing under MSF allows banks to use their SLR securities, which is not permitted when borrowing under the Repo Rate.

Features Marginal Standing Facility (MSF) Rate

- It has a higher Interest Rate so the MSF rate is kept higher than the repo rate to prevent overuse.

- It’s emergency borrowing so banks use MSF only when they cannot borrow from other sources.

- To borrow money from the RBI banks must keep collateral with the RBI.

- It’s known as an overnight Loan and banks must pay the money borrowed under MSF the next working day.

Impact of Marginal Standing Facility (MSF) Rate

Increase in MSF Rate: Borrowing becomes expensive for banks and banks may increase loan interest rates, making loans costlier for the public.

Decrease in MSF Rate: Banks can borrow money at a lower cost and loans become cheaper for individuals and businesses. It also helps boost economic activity.

FAQs

What is the Marginal Standing Facility (MSF)?

The Marginal Standing Facility (MSF) is like a safety cushion set up by the Reserve Bank of India (RBI) to support banks when they face sudden cash crunches. Through this, scheduled commercial banks can borrow funds overnight by pledging government securities.

What is the difference between repo rate and marginal standing facility?

The repo rate is basically the interest rate at which banks can borrow money from the RBI using government securities under regular circumstances. On the other hand, the Marginal Standing Facility (MSF) rate is a bit higher and comes into play during emergencies when banks are dealing with severe cash crunches.

How does the MSF impact the economy?

The Marginal Standing Facility (MSF) serves as a cap for short-term interest rates in the money market, acting like a gentle nudge from the RBI to encourage banks to borrow only when necessary and to handle liquidity more thoughtfully. By setting this higher-than-usual rate, the RBI signals how it plans to manage liquidity while also shaping interest rate trends across the economy. It’s a way the central bank keeps things steady, ensuring the financial system stays balanced and resilient.

Related Indicators

Important

If you notice any discrepancies in the data or find any inaccuracies, please let us know. We will review and correct them as soon as possible.

Other Indicators

Inflation and Price Indicators

- Inflation Rate

- Consumer Price Index

- Wholesale Price Index

- Food Inflation (CFPI)

- Health Inflation

- Education Inflation

- CPI Housing Utilities

- Inflation Expectations

GDP & Economic Growth Indicator

- GDP

- Full Year GDP Growth

- GDP per Capita

- GDP from Agriculture

- GDP from Construction

- Goods and Services Tax (GST) Revenue

- Imports

- Exports