RBI Bank Rate

RBI's Bank Rate: Key Updates

Latest Release

June 6, 2025

Actual

5.75%

Previous

6.25%

Highlights

- After assessing the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) decided to reduce the Bank Rate to 5.75 percent, following a 50 basis point cut in the policy repo rate.

- The decision was taken during the 55th meeting of the MPC held from June 4 to 6, 2025, under the chairmanship of RBI Governor Shri Sanjay Malhotra.

- The Bank Rate, which is traditionally used by the RBI for long-term lending to financial institutions, now aligns with the MSF rate and forms the upper bound of the policy corridor.

Reasons for the Bank Rate Cut by RBI (June 2025)

As per the June 2025 Monetary Policy Statement:

- Decline in Inflation: CPI inflation dropped to 3.2% in April 2025, a 6-year low. Food prices fell for six consecutive months. Core inflation stayed stable and contained.

- Revised Inflation Forecast: FY 2025-26 inflation estimate was reduced to 3.7% from 4%.

- Need to Support Growth: GDP growth, while improving, is at 6.5%, which is below full potential. The rate cut aims to boost consumption and private investment.

- Agricultural Strength: Record Rabi output and a forecast of an above-normal monsoon should help maintain food price stability.

- Global Economic Uncertainty: Ongoing geopolitical risks, trade tensions, and global slowdown require a supportive domestic monetary policy.

Expected Effects of the Bank Rate Cut

- Cost of Borrowing for Banks: Aligns the cost of long-term borrowing from the RBI with the overall easing trend.

- Signals Policy Direction: Reinforces RBI’s pro-growth stance while keeping inflation under control.

- Consistency Across Corridor: Keeps the MSF, Repo, SDF, and Bank Rates aligned and predictable for financial institutions.

- Support for Broader Financial System: Helps maintain financial stability and encourages increased lending and liquidity.

Historical RBI's Bank Rate Chart

Bank Rate Chart (RBI) - Historical & Current Trends

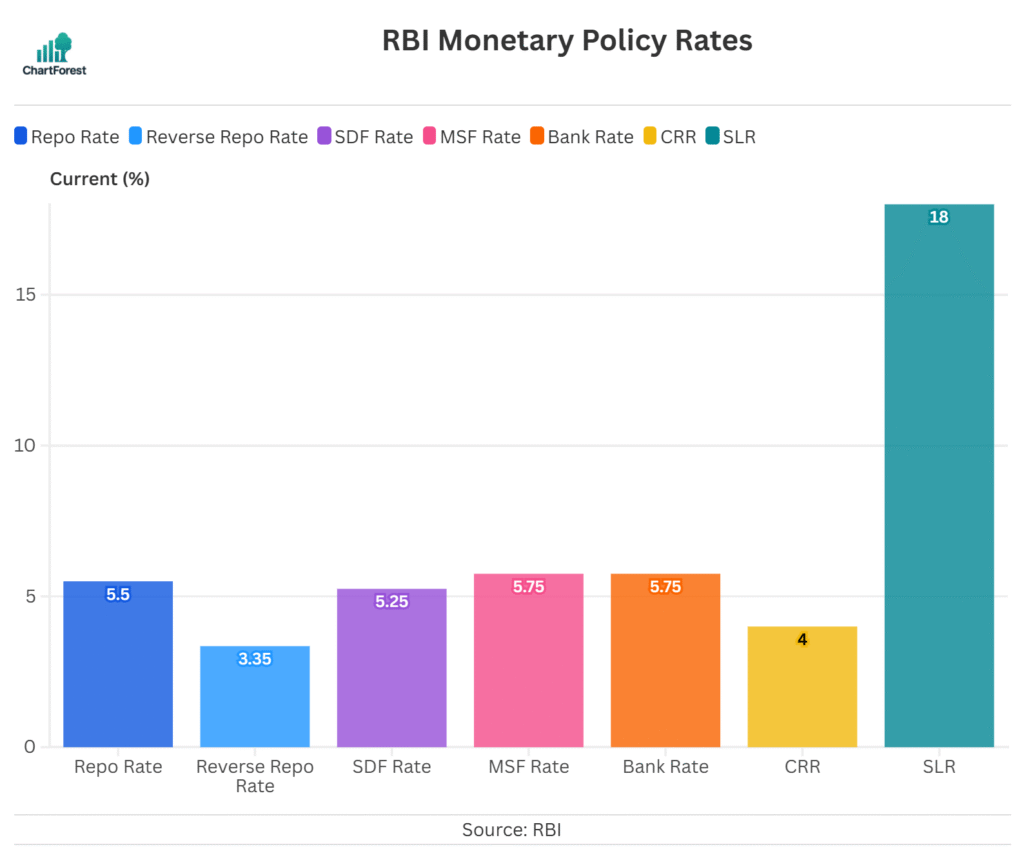

RBI Policy Rates & Ratios

RBI's Bank Rate overview

The Bank Rate is the rate that is charged by the RBI (central bank) while giving loans to commercial banks. It provides a facility in which banks do not require to keep collateral with the RBI while borrowing money from it. Banks facing a shortage of funds can borrow from the central bank at this rate.

The RBI changes the bank rate after evaluating the economic conditions. The main purpose is to control inflation and stabilize economy.

RBI's Bank Rate Change Impact

Increase Bank Rate: It makes borrowing expensive for banks and banks increase loan interest rates, making home, car, and business loans costlier. Moreover, this also helps control inflation by reducing excess money in circulation.

Decrease Bank Rate: It makes banks get cheaper loans from the RBI which makes loan interest rates for businesses and individuals decrease, encouraging them to borrow. Moreover, this helps boost economic growth during slowdowns.

FAQs

What is the bank rate and how does it work?

The bank rate is basically the interest rate the Reserve Bank of India (RBI) uses to lend long-term funds to commercial banks, and the best part is they don’t need to provide any collateral for it. It’s like a guiding rate for the financial system, helping to manage inflation and liquidity, and keeping the economy steady and balanced.

How is it different from the Repo Rate?

Both are lending rates set by the RBI, but the repo rate is meant for short-term borrowing, usually overnight, and requires collateral like government securities. The bank rate, however, applies to longer-term loans, doesn’t need collateral, and is typically higher than the repo rate, though it’s not used as often.

What factors influence RBI’s decision to change the Bank Rate?

The RBI looks at a bunch of important factors like inflation trends, GDP growth, liquidity in the market, credit demand, and global economic signals to get a sense of how things are shaping up. Based on that, it tweaks the bank rate to either boost borrowing or ease it, helping keep the economy on the right track.

How does the bank rate affect the economy?

The bank rate plays a big role in shaping how banks borrow money, and it directly affects the economy. When the rate goes up, loans become more expensive, making borrowing tougher and slowing down inflation. On the flip side, when the rate drops, borrowing gets cheaper, which encourages spending, loans, and economic growth. In this way, the RBI uses the bank rate as a handy tool to manage liquidity, keep inflation in check, and steer overall economic activity.

Related Indicators

Important

If you notice any discrepancies in the data or find any inaccuracies, please let us know. We will review and correct them as soon as possible.

Other Indicators

Inflation and Price Indicators

- Inflation Rate

- Consumer Price Index

- Wholesale Price Index

- Food Inflation (CFPI)

- Health Inflation

- Education Inflation

- CPI Housing Utilities

- Inflation Expectations

GDP & Economic Growth Indicator

- GDP

- Full Year GDP Growth

- GDP per Capita

- GDP from Agriculture

- GDP from Construction

- Goods and Services Tax (GST) Revenue

- Imports

- Exports